Breaking Language Barriers: How Lenders Harness AI and Machine Learning for Seamless Communication

![]()

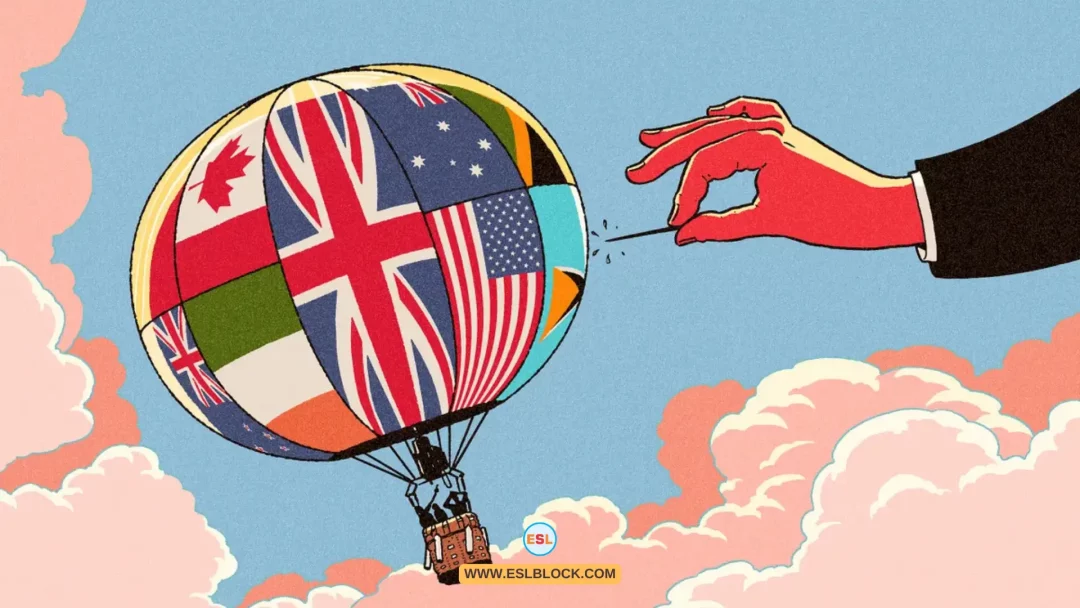

Revolutionizing Financial Interactions Through Advanced Language Solutions in the Era of Artificial Intelligence

In a groundbreaking shift, lenders are adopting cutting-edge AI and machine learning technologies to address the language barriers faced by Americans with Limited English Proficiency (LEP) during the mortgage application process. With over 25 million people in the U.S. falling under the LEP category, the mortgage industry is leveraging innovative solutions to enhance communication and accessibility.

Also Read: How to Teach the Alphabet to Preschoolers?

Currently, there is no federal mandate for mortgage documents to be provided in languages other than English, yet lenders are recognizing the market potential within the Spanish-speaking population. The National Association of Hispanic Real Estate Professionals highlights the significant number of mortgage-ready Latinos, emphasizing the growth in Hispanic homeownership rates.

Wolters Kluwer, a prominent player in the financial services industry, is at the forefront of addressing this challenge. Crystal Coker, Senior Technology Product Manager at Wolters Kluwer, sheds light on the importance of investment in translation resources, citing both customer service and business expansion as key drivers.

Coker discusses the evolving landscape of language preferences in mortgage lending, highlighting the recommendations from regulatory bodies like the Consumer Financial Protection Bureau (CFPB) and Federal Housing Finance Agency (FHFA) to offer services in non-English languages. She emphasizes that Wolters Kluwer’s Expere® Language Translation Solution, backed by AI and ML, is designed to meet the unique needs of lenders and servicers.

Addressing potential pitfalls in language translations, Coker emphasizes the expense, time consumption, and the risk of human error. She underscores the role of AI and ML technology in streamlining the process, noting that Wolters Kluwer’s integrated approach, involving linguistic and compliance experts, ensures both accuracy and efficiency.

Detailing the Expere Language Translation process, Coker outlines the use of AI, ML, and compliance dictionaries to provide precise translations. She highlights the pivotal role of bilingual linguistic experts who validate translations, contributing to ongoing improvements in accuracy. The automated doc prep workflow has enabled Wolters Kluwer to significantly increase the efficiency of translation services.

The article concludes by showcasing the transformative impact of AI and ML on translation services, with a shift from 80% manual translations to 96% AI/ML-assisted translations. As the mortgage industry embraces technology-driven solutions, Wolters Kluwer continues to lead the way in providing a streamlined and accurate language translation experience for lenders catering to diverse language preferences in the ever-evolving mortgage landscape.

If you have enjoyed “How Lenders Harness AI and Machine Learning for Seamless Communication” I would be very thankful if you’d help spread it by emailing it to your friends or sharing it on Twitter, Instagram, Pinterest, or Facebook. Thank you!

More Free Resources

Here are some more lists for you!

- Unveiling the Reasons: Why Isn’t English the Official Language of the United States?

- Amherst Schools’ Bilingual Education Program Faces Funding Setback: Implications for Dual-Language Learning

- Empowering Knowledge: Rabbi Shalom Rosner to Lead JCT’s English-Language Beit Midrash Program

- Unlock Opportunities: English Language Institute Seeks Conversation Group Leaders

- Bridging Borders: English Professor’s Fulbright Award Sparks Global Collaboration